Interest Rates and Bond Prices Are Positively Related

When interest rates go up bond prices go down and when interest rates go down bond prices go up. Conversely when rates decline bond prices.

A Bond Convexity Primer Cfa Institute Enterprising Investor

Bond prices and interest rate are inversely related.

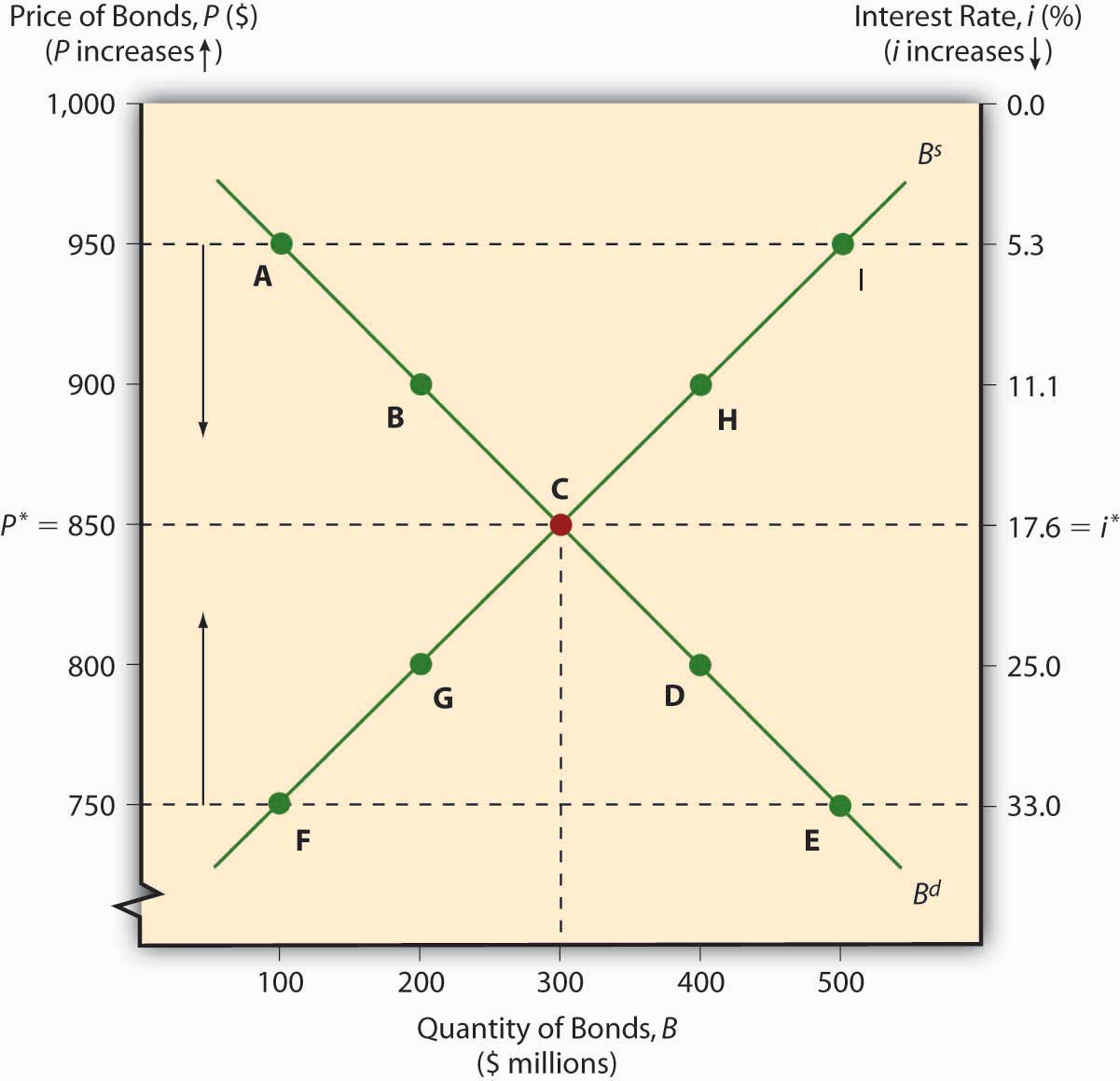

. If the face value of bond is 1000 and the best price one has received is 950 then the interest will be 53. This interest varies based upon the price one receives from the buyer. In actual there is no such relation between bond prices and currency exchange rates.

Learn why interest rates affect the price of bonds and how you can take a position on the bond market. Central banks have been in a dovish cycle which reduces interest. Investors switchting between bonds and stocks could sell bonds and buy stocks in times of rising yields fearing that his developement will last which increases demand for stocks.

True False Bond prices and interest rates are directly or positively related. Essentially bonds and interest rates have an inverse relationship. Who are the experts.

When bond prices are high then interest rate will be less but when bond prices are low interest rate will be higher. Bond prices move inversely to interest rates. Open an Account Today.

Experts are tested by Chegg as specialists in their subject area. The interest rate on the bond or the yield to maturity is the discount rate. Bonds with a higher interest rate are often considered a higher risk investment because when interest rates rise bond prices fall.

Bonds have an inverse relationship to interest rates. Indicate whether the statement is true or false. Heres what to know.

Interest rates have been at historic lows since the 2008 financial crisis. This means when interest rates go up bond prices go up and vice versa. The bond prices vary based upon the price obtained from the buyer.

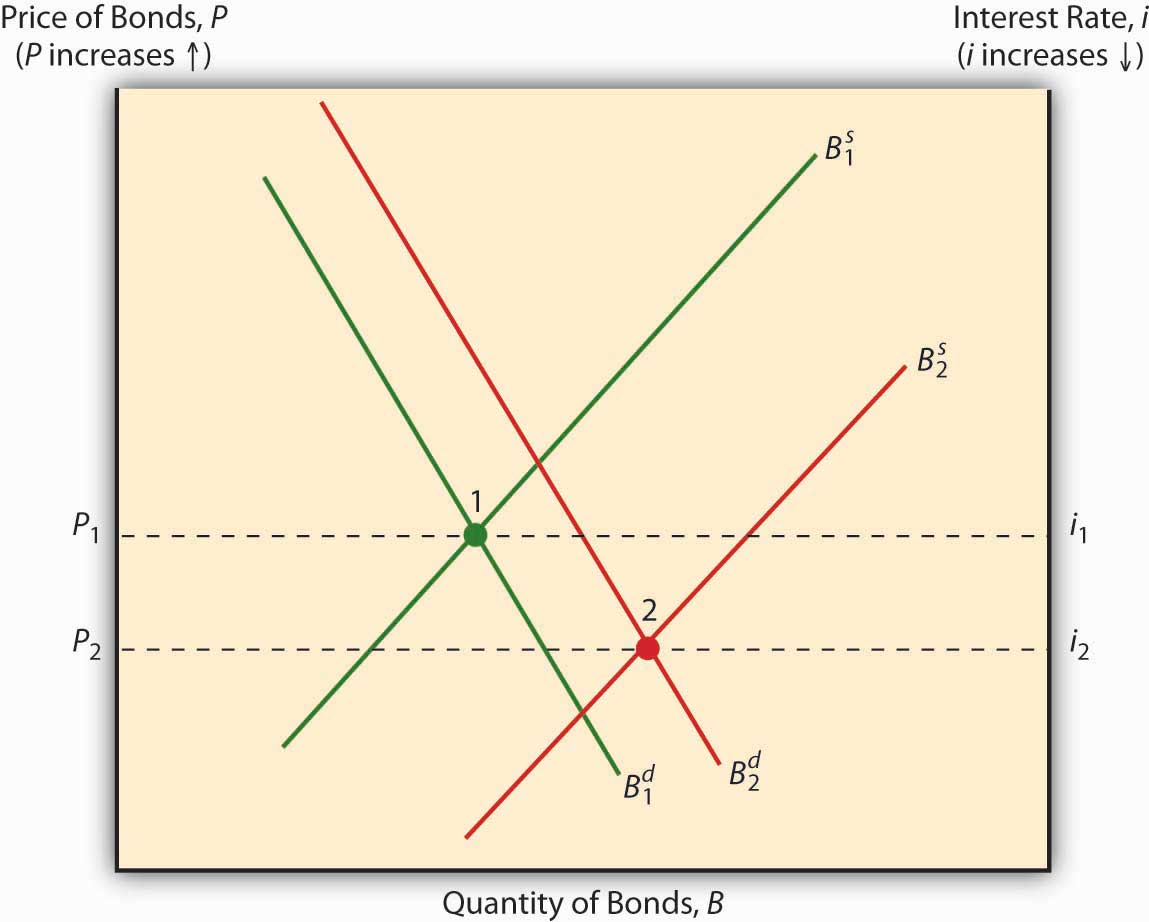

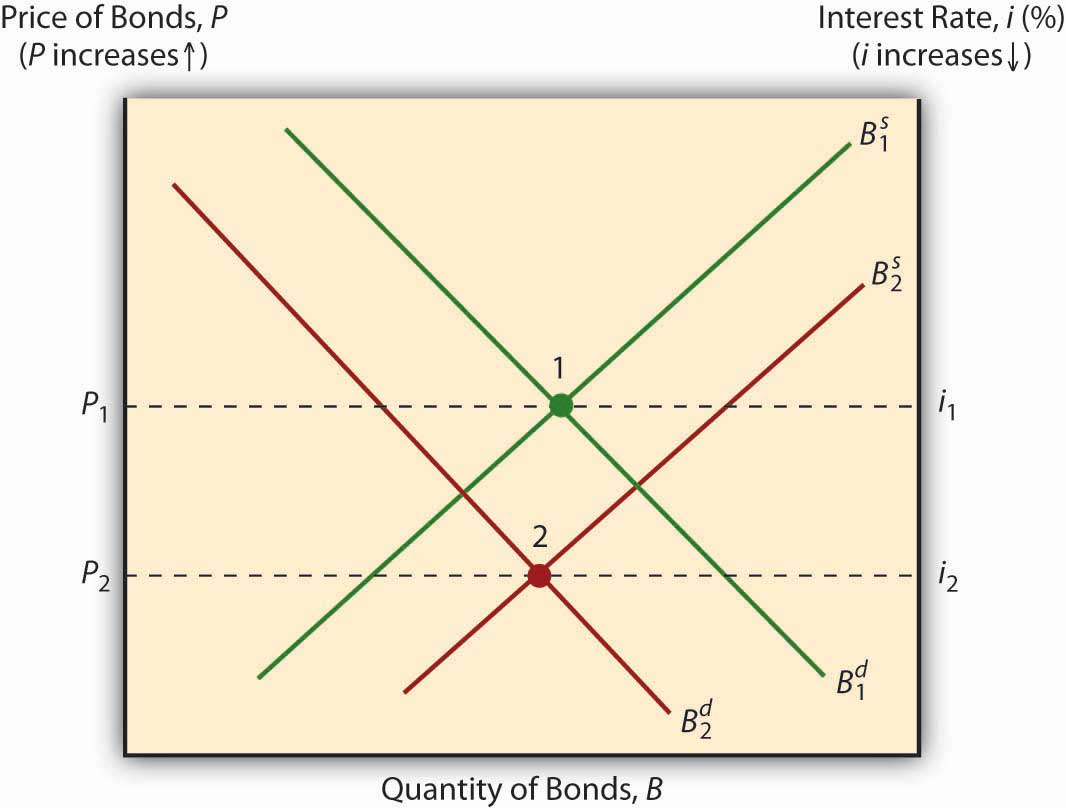

When its cheap to store inventory businesses have more demand to stock up which pushes costs higher. We can represent this on a single diagram with two y-axes one representing the bond price which increases as we move up along the axis and the other representing the interest rate which decreases as we move up along the axis. Since the interest rate moves in a direction opposite to the bond price interest rates and the quantity of bonds demanded are positively related.

Eman Asked on February 1 2018 in economics. B The price of a coupon bond and the yield to maturity are positively related. Higher interest rates mean lower bond prices for bonds already emmitted.

Bond prices have an inverse relationship with interest rates which means that as interest rates rise bond prices drop. As of Nov. As an investment vehicle bonds arent what they once were.

When interest rates decrease its cheaper for companies to borrow capital with the aim of achieving growth and this may encourage stock prices to. 1 2019 Series I savings bonds rates equaled 222 with a portion indexed to inflation according to TreasuryDirect. Bond prices move inversely to interest rates.

The price of bonds and interest rates are apositively related bnegatively related cunrelated ddirectly related ecannot be determined because the CPI of the year is not given. True False The public debt is the accumulation of all deficits and surpluses that have occurred through time. As the coupon rate increases the bond price will increase.

Interest rates and bond prices are positively related to one another. The inverse relationship is easy to see with this simple illustration. Option B is correct.

Bond prices and interest rates are inversely related with increases in interest rates causing a decline in bond prices. When interest rates rise bond prices fall and vice versa. Interest rates have an inverse relationship with bond prices.

As the discount rate gets larger the price of the bond will decrease. Ad Put Your Investment Plans Into Action With Personalized Tools. Bond prices and interest rates are inversely related.

So when you buy a bond you commit to receiving a fixed rate of return ROR for a set period. Changes in short-term versus long-term interest rates can affect various bonds in different. We review their content and use your feedback to keep the quality high.

When the cost of borrowing money rises when interest rates rise bond prices usually fall. A bond is issued for 10000 for five years with a 5 coupon or. The Federal Reserve started gradually raising rates but quickly lowered them to close to 0 as a response to the COVID-19 crisis.

Interest rate risk is the risk of changes in a bonds price due to changes in prevailing interest rates. Interest rates and commodity prices have an inverse relationship because the costs associated with holding inventory decrease in low-interest-rate environments. Remember were talking about previously issued bonds trading on the open market.

38 C The yield is less than the coupon rate when the bond price is below the par value.

2022 Cfa Level I Exam Cfa Study Preparation

:max_bytes(150000):strip_icc()/dotdash_Final_The_Predictive_Powers_of_the_Bond_Yield_Curve_Dec_2020-02-2c724203ef1e41ce82291df3676bb392.jpg)

The Predictive Powers Of The Bond Yield Curve

Economics Of Money Chapter 5 Flashcards Easy Notecards

The Economics Of Interest Rate Fluctuations

The Economics Of Interest Rate Fluctuations

Gold And Bond Yields Link Explained Sunshine Profits

How Do Interest Rates Affect Bond Prices Ig En

.png)

How Do Interest Rates Affect Bond Prices Ig En

2022 Cfa Level I Exam Cfa Study Preparation

Understanding The Relationship Between Interest Rates And Bond Prices

Bond Prices Rates And Yields Fidelity

Yield Curve Economics Britannica

A Bond Convexity Primer Cfa Institute Enterprising Investor

Relationship Between Bond Prices And Interest Rates Video Khan Academy

The Economics Of Interest Rate Fluctuations

Why Is There An Inverse Relationship Between Bond Prices And Interest Rates Quora

/Convexity22-0370dbde8e1c4a958bff8b670bf8bf5c.png)

/Convexity22-0370dbde8e1c4a958bff8b670bf8bf5c.png)